This morning, Peloton released its second-quarter fiscal year 2024 results, with the headline being as statement of the “business is not going away.”

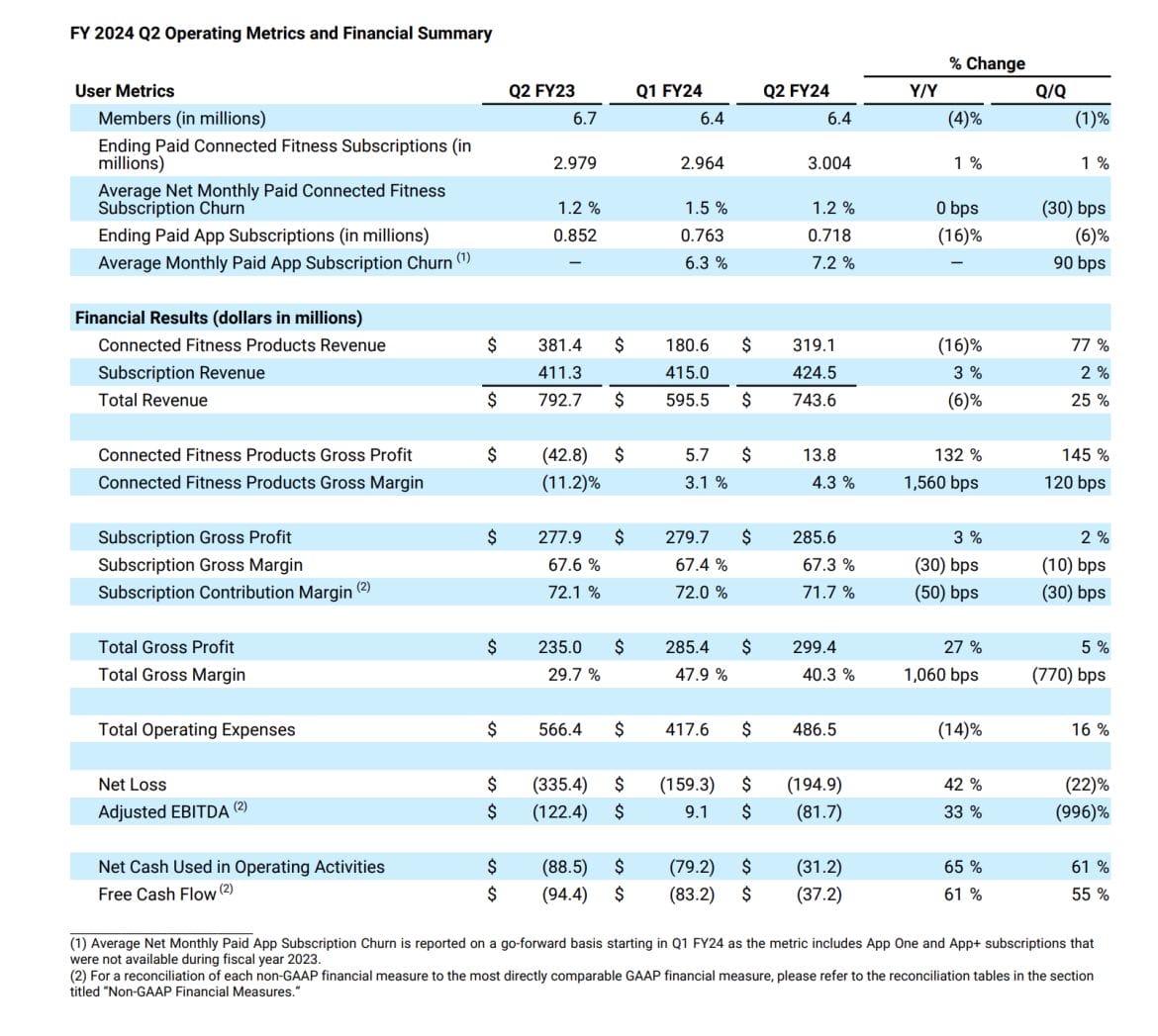

The company reported a second quarter loss of 54 cents per share on a revenue of $743.6 million, where analysts had predicted a loss of 53 cents per share. This was comprised of $319.1 million of Connected Fitness segment revenue and $424.5 million of Subscription revenue, comparing to their $715 million to $750 million guidance range. Analysts had predicted around $733 of revenue.

Peloton estimated revenue for Q3 2024 to be between $700-$725 million, which was under industry estimates.

The stock value is trending downward in the initial hours following the release of Peloton’s data, with the stock being down 10% at time of publishing (this is fluctuating and changing by the minute).

Peloton CEO Barry McCarthy stated in the letter than they now expected the company to be free cash flow positive in FY 2024 Q4, but would not be free cash flow positive for the overall year.

In this second quarter report, McCarthy started with the failures stating “If we’re not failing, we’re not being aggressive enough testing new initiatives.” The co-branded Bike experiment with the University of Michigan fell flat, even with the school winning the national championship, they sold substantially less Bikes to alumni and boosters than they expected. All plans to launch additional co-branded Bikes have been scrapped.

The second area of business McCarthy touched on was Member Support (he said “think customer service”). McCarthy stated “This past holiday season was particularly taxing for Members. The Member Support experience has tarnished our brand, and we simply must do better.” He went on to say that the team is being rebooted with new leadership, new systems and new third-party vendors. In the investor letter, McCarthy used the word “confident” three times, but surely Members will take a “see it to believe it” attitude until the experience is vastly improved.

McCarthy jumped right into the growth and successes with third party retailers like Dick’s and Amazon being called out for the strong sales growth over the holiday season with a year-over-year growth of 74% in Q2. The key learning from his holiday season will be to better optimize sales and marketing tactics going forward to yield better results for the brand.

Bike rental continues to be another successful growth initiative for Peloton. McCarthy says that they are forecasting more than 100% year-over-year growth for FY24 and is attracting a more diverse, female and younger customer than just six months ago. Look for this business model in Corporate Wellness later this fiscal year, as this segment of their business is growing quickly. They recently launched a self-service buyout financing option that has delivered a sharp increase in buy-out activity and 11% of the rental base choosing to purchase in Q2.

The demand for Tread+ is encouraging as McCarthy stated that it’s been significantly stronger than expected. That interest in Tread+ has increased consumer demand for the entry-level Tread, which outperformed expectations for sales last quarter. He stated “The overall treadmill market is about 2x larger than the stationary bike market. So, our newly found momentum in the treadmill category, and the diversification of our hardware sales beyond Bike/Bike+ is good news for Peloton’s future growth, provided we sustain our momentum.” Recently they announced auto-incline and access to Lanebreak gamified workouts on the Tread+. McCarthy also mentioned that there are new training programs and content coming to the equipment, and hopes to expand their partnerships to other marathons aside from New York Road Runners and the New York City Marathon.

McCarthy also highlighted the performance of subsidiary Precor. There was Q2 revenue of $70 million which can be credited to the rebuilt leadership team who executed a turn around plan that saw the North Carolina facility shuttered, a shift in international sales from direct to indirect dealer, and other major changes within the brand.

The collaboration with lululemon outperformed expectations last quarter with Peloton becoming the exclusive digital fitness content provider for the Studio platform. But, the apparel collaboration had a slower start than expected – we previously shared Peloton & lululemon statements related to trying to be more size inclusive.

McCarthy also teased “product innovation” from Peloton taking place over the next two years. He didn’t go into any additional details, but stressed that Peloton would begin innovation on products again – not just on software. He also stressed that personalization and AI would make their way into more of the Peloton apps and experiences over time.

The formalized relationship with TikTok, while further down in the investor letter was discussed with McCarthy stating “We are excited to see where this goes. We are producing bespoke social content – such as original short-form instructor series, Peloton class clips, celebrity collaborations, live Peloton classes and ongoing creator partnerships – for the first time outside of Peloton-owned channels.” McCarthy also noted that despite the recent news of Universal Music and TikTok’s dispute over music licensing, all content that Peloton creates on the platform is fully licensed an this will not impact this relationship.

You can see Peloton’s full earnings and letter to investors on the investor website.

Support the site! Enjoy the news & guides we provide? Help us keep bringing you the news. Pelo Buddy is completely free, but you can help support the site with a one-time or monthly donation that will go to our writers, editors, and more. Find out more details here.

Get Our Newsletter Want to be sure to never miss any Peloton news? Sign up for our newsletter and get all the latest Peloton updates & Peloton rumors sent directly to your inbox.

As a member, this company is doing everything right to expand their audience and attract more members. The coaches are phenomenal and the content is first class. It doesn’t compare to a fitness class at a local gym and I really appreciate doing this caliber of workout at home. I guess Peloton is still digesting the poor decisions of the covid era but it’s hard to deny they are the definitive company for connected fitness. I think once they start cutting interest rates, maybe peloton can refinance old debt and the stock can start moving again. The business seems sound and is only getting better under Barry McCarthy