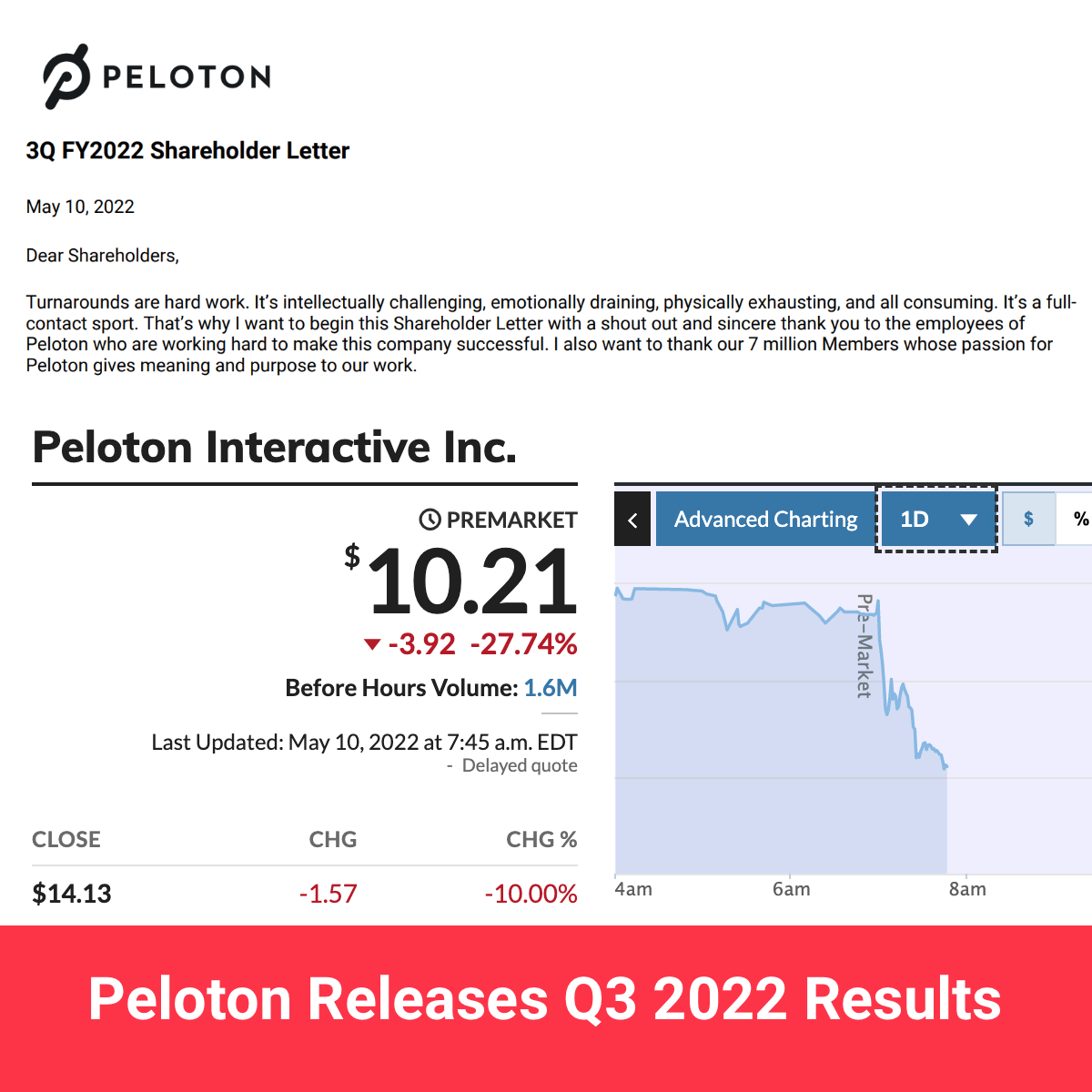

This morning, Peloton released their Q3 2022 earnings data.

In it, Peloton reported bigger than expected losses for the quarter. They reported a loss of $2.27 per share, while the consensus estimates had expected them to have a loss of $0.83 per share. Peloton’s revenue for the quarter was $964.3 million – lower than the consensus estimates of $972.9 million. This news has caused the stock price to drop 20% or more in pre-market trading.

Peloton’s new CEO Barry McCarthy called out a few areas he thought the company could improve going forward to help Peloton further drive their growth. This includes working more with 3rd party retailers (in the UK you can already find Peloton equipment in John Lewis showrooms, and in Australia they are available in David Jones showrooms). They also plan to utilize their digital app more to reach more subscribers that way. It also sounds like Peloton will continue to expand their One Peloton Club bike rental program, which is described as Fitness-as-a-Service (“FaaS”)

In the months ahead you’ll see us evolve our go-to-market strategy to grow faster. One new initiative includes broadening our distribution to third party retailers. Another involves rethinking the value proposition of our digital app to drive significantly more top of marketing funnel growth. A third initiative involves expanding our international markets. And fourth, we continue to test and broaden the roll out of Fitness-as-a-Service (“FaaS”). FaaS is a rental program that combines the cost of connected fitness hardware and our All-Access subscription service into one low monthly fee. We’ve tested different price points in order to understand the interplay of consumer demand and ROI, which is a function of variables like CAC, churn, return rates, and buy out rates. To date we’ve seen steady increases in growth (on the order of 90%+ uplift currently) compared to our control markets, and we are broadening the size of our test markets as we continue testing different consumer offers.

He also notes that Peloton plans to expand their international markets. Peloton’s most recent new market launch was in Australia, where they officially launched in July 2021.

Peloton did report that they hit 7.0 million subscribers this quarter. In the earnings report, Barry stated he also believes, like John Foley did, that Peloton can eventually have 100 million subscribers.

My goal for Peloton is to become a global connected fitness platform with 100 million Members. That’s equivalent to roughly half the world’s global gym memberships. It’s a long, long way from where we sit today. But we sit at the epicenter of technology enabled fitness, a long-term secular growth trend. Who doesn’t want to live a healthier, happier, longer life? We will share more about how we plan to participate in that growth in the months and years ahead.

The average number of workouts per month per subscriber increased this quarter to 18.8. Last quarter it had been 15.5.

Peloton did not state in the letter when the Peloton Tread+ might be available for sale again. They did note that they are seeing “higher than anticipated Tread+ returns”

With these losses, and amid reports Peloton was looking for new minority investors, Peloton also reported they had secured $750 in new debt financing

We finished the quarter with $879 million in unrestricted cash and cash equivalents, which leaves us thinly capitalized for a business of our scale. Earlier this week we took steps to strengthen our balance sheet by signing a binding commitment letter with JP Morgan and Goldman Sachs to borrow $750 million in 5-year term debt. I want to thank everyone involved for their hard work in completing this important financing and look forward to reporting on our progress in reshaping Peloton’s business in the quarters ahead. As we begin to sell down our excess inventory, the current cash flow headwind should become a tailwind in FY23. Our goal is to restore the business to positive free cash flow in FY23.

Peloton also shared that they expected next quarters results to be lower than they initially forecasted back in February.

Our Q4 outlook reflects softer demand vs. our February forecast, partially offset by accelerated sales we’ve seen as a result of our recent hardware price reductions. Our Q4 ending CF subscriber forecast of approximately 2.98 million incorporates a modest negative impact from our Subscription pricing increase starting June 1. As anticipated, we have seen a small increase to cancellations due to the Connected Fitness subscription price increase announcement, but we expect the impact to moderate as we progress through FY23. We forecast total revenue of $675 million to $700 million in Q4.

Barry also shared that the company also has too much inventory – but expects to eventually be able to sell all the bikes & Treads they have sitting in warehouses.

The balance sheet challenge has been managing inventory. We have too much for the current run rate of the business, and that inventory has consumed an enormous amount of cash, more than we expected, which has caused us to rethink our capital structure (more on this in a moment). Fortunately, the obsolescence risk is negligible, and we believe the inventory will sell eventually, so this is primarily a cash flow timing issue, not a structural issue.

Support the site! Enjoy the news & guides we provide? Help us keep bringing you the news. Pelo Buddy is completely free, but you can help support the site with a one-time or monthly donation that will go to our writers, editors, and more. Find out more details here.

Get Our Newsletter Want to be sure to never miss any Peloton news? Sign up for our newsletter and get all the latest Peloton updates & Peloton rumors sent directly to your inbox.

Leave a Reply